Carteira Passiva de ETFs da B3/BOVESPA para 2023

Construída com ETFs

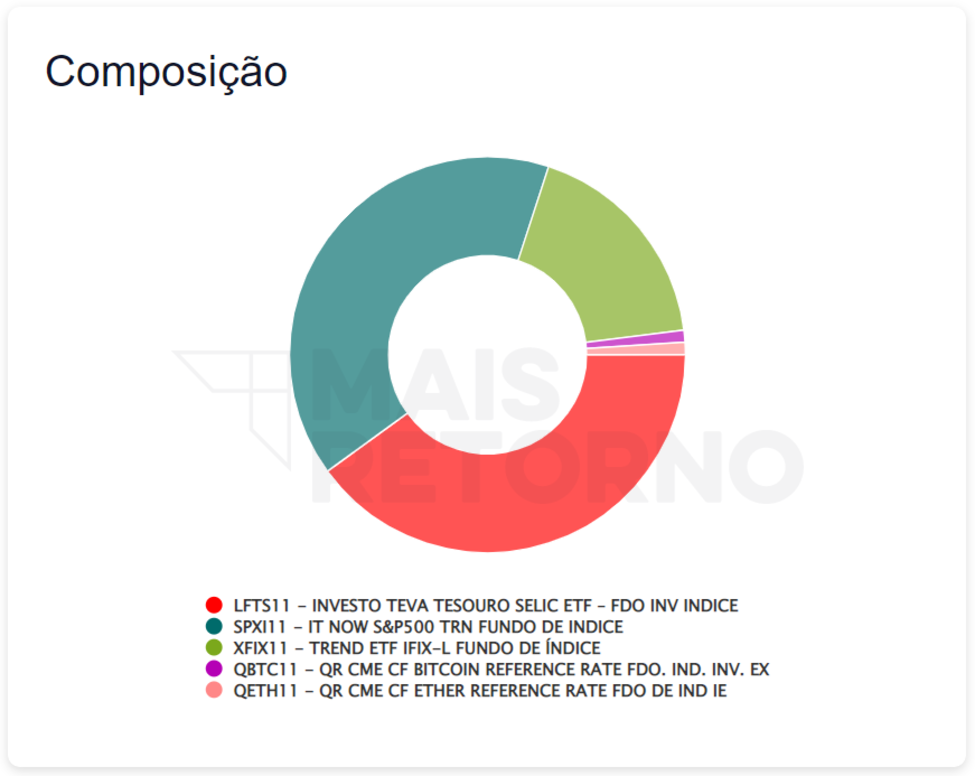

Tenha uma carteira passiva e diversificada, entre diferentes classes de ativos, moedas e geografias, utilizando ETFs negociados na própria B3.

Perfil Agressivo

Carteira voltada para investidores de perfil agressivo, visto que a carteira aloca 60% em renda variável, incluindo 2% de exposição em criptomoedas.

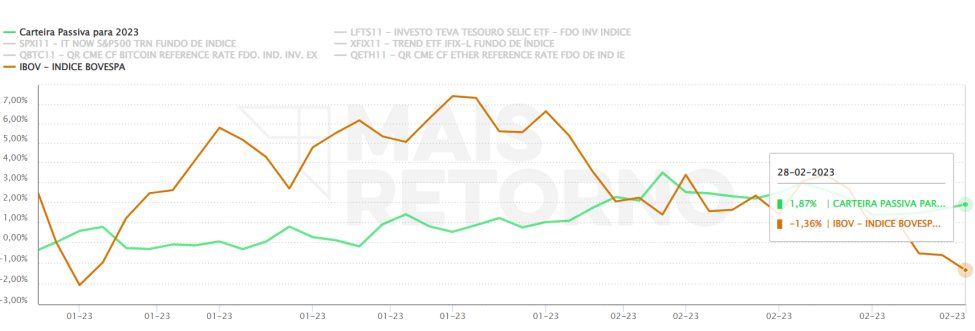

Rebalanceamento

Este relatório não contempla rebalanceamento, mas isso pode ser feito comprando mais do ETF (ou ETFs) com percentual atual abaixo da alocação inicial.